These Case Studies are actual clients:

Their names have been changed to protect their privacy

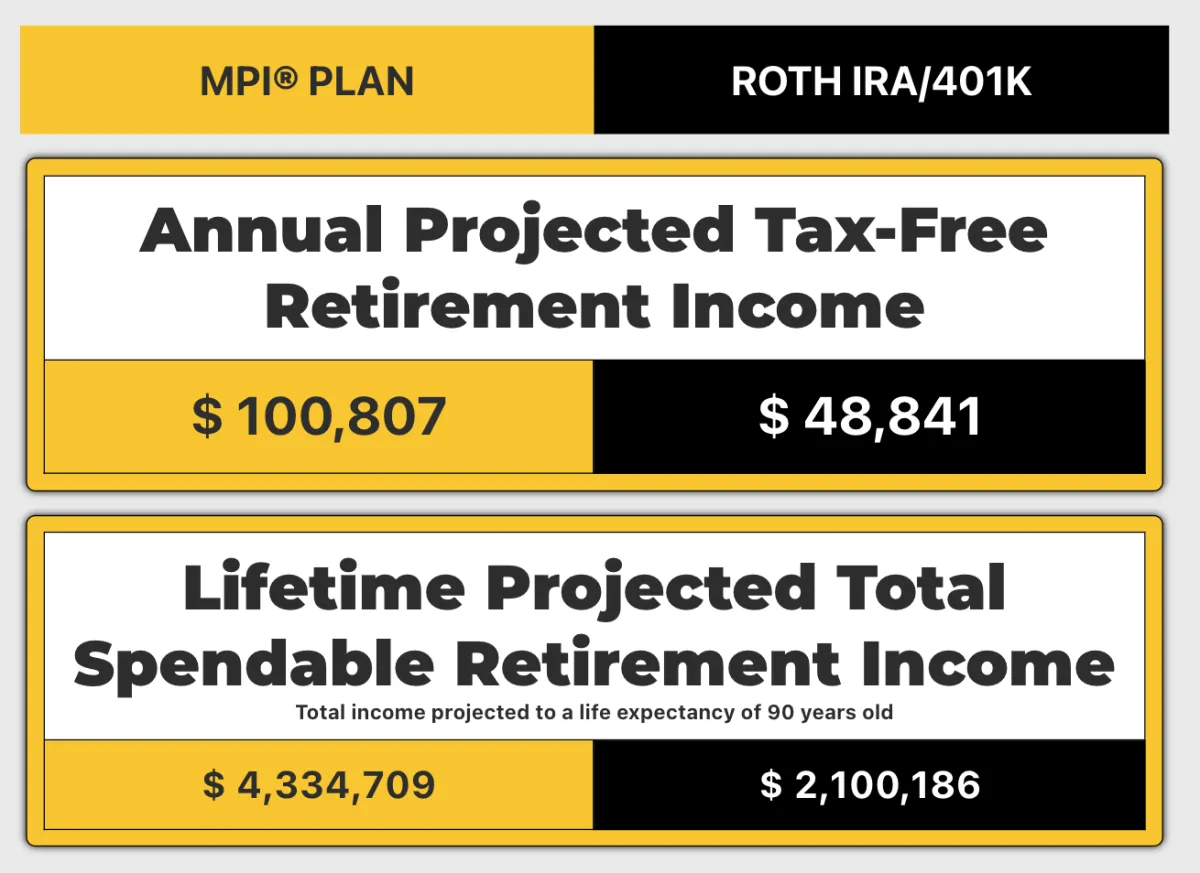

Alicia & Mark

Ages: 36 & 38

Total Income: $136k

Can Retire in 11 yrs

with $100k/yr in

TAX FREE INCOME

This couple learned to live off Mark's $80k income while they welcomed their new baby into the family. Alicia recently went back into the workforce and is now making 56K. Because they have survived off one income for the last year, the goal is to use 100% of Alicia’s income to fund their MPI Plan. Doing so will allow them to get their money compounding quickly, and expedite an early retirement for both of them.

THEIR GOAL: to create a $1M nest egg and $100K per year in tax free income, have time as a family, safeguard their money against market volatility and have more options for the future.

In just 11 years, Alicia will be able to retire both she and her husband if she chose to do so, or they both can continue working, even if only part time.

The $1M Baby

Age: 14 days

Can Retire in 40 yrs

with $100k/yr in

TAX FREE INCOME

FOR LIFE

Don't sleep on this opportunity for your newborn, or any children for that matter. Not only is this an asset for any child, but also equal leverage for the parents as the policy holder. Children also qualify as an "insurable interest" for those who may not personally qualify for an MPI plan due to health or other reason.

THE GOAL: Contribute only until age 18, Child will have enough leverage and tax free income to become their own bank by age 30. Savings plan for a newborn, committing $250/month starting at 14 days old until age 18, and never paying a dime more.

Age 18, $54K in account value

Age 30, $396K

Age 40, $918K

Age 50, $1.982M

Age 60, up to $4M dollars

Image that this child has had access to capital for school, buying their first car/house, and investments such as real estate or non traditional investments you cannot purchase with a traditional retirement plan. This child could also start taking a tax free income for life, around age 40, if they wanted to.

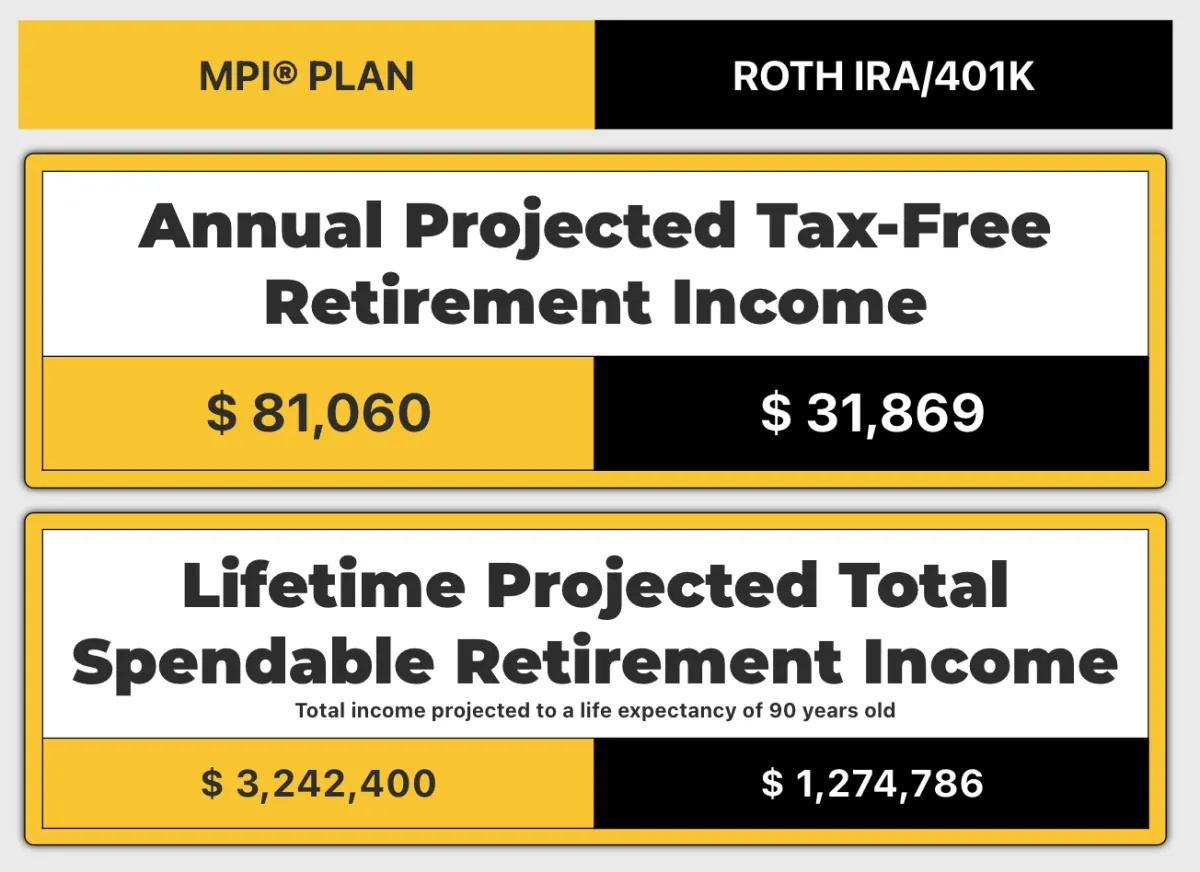

Jake

Age: 22

Total Income: $47k

Contribution: $500/mo

Can Retire by age 50

with $81,060 or $6,755/mo in

TAX FREE INCOME

FOR LIFE

Jake is just getting started making a steady income while living at home with his parents. While he plans to get his own place, he wants to make sure his future plans don't set him up for the same "trap" he sees his parents and older siblings fell into. He wants his story to be different.

HIS GOAL: to "never have to work again" by the age of 50. Watching his parents struggle, he knows now that he does not want to be forced to work, or depend on relevance in the workplace to survive.

Regardless of Jakes income, if he can contribute 500/month into an MPI plan, he is projected to have $6,750/mo in tax free retirement income for the rest of your life. That’s $3.2M through retirement of tax free compound interest.

Jacque

Age: 31

Contribution: $800/mo

Can Retire in 24 yrs

with $88.9k/yr in

TAX FREE INCOME

FOR LIFE

Jacque has decided to make some lifestyle decisions to free up some of her budget and now can put away $800/month to securely compound in an MPI plan.

HER GOAL: to "exit the matrix" and retire by age 55.

Here's the Math: She would have contributed over that 24 year period a total of $230K, which would produce $88,900 per year in tax free retirement income at age 55 for the rest of her life. That a total of $3.1M in total retirement.

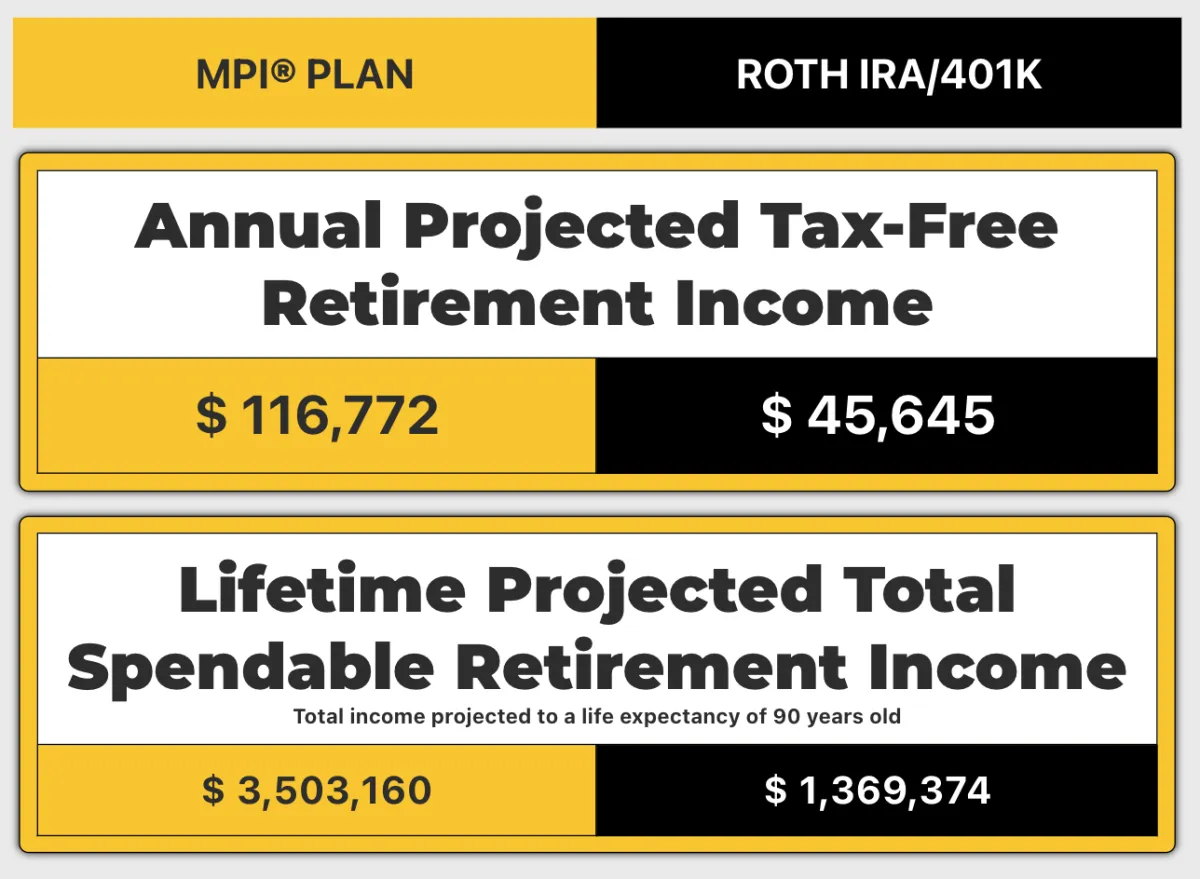

Jeremy

Age: 33

Total Income: $65k

Savings: $12k

Contribution: $700/mo

Can Retire by age 60

with $116,772 or $9,671/mo in

TAX FREE INCOME

FOR LIFE

Jeremy just got married, and plans to start a family. He is fearful that he's behind the ball to start getting serious about a retirement plan because the autopilot strategy through his employer will not be enough, nor is it leverageable, secure or flexible as to what age he can retire.

He "doesn't want the government telling him when he can or can't stop working". He knows sometimes life circumstances dictate that change.

HIS GOAL: to be free of rules about his money, be able to switch jobs if he needs to and truly own his retirement plan. He wants to be in control, and securely self directed.

On the 1st zoom call, I created a free 12 point plan based on Jeremy's goals and his average income. Now he knows how & where he can pivot to leverage or fuel his plan. If he consistently contributes a min of $700/month into an MPI plan, he is projected to have $9,671/mo in tax free retirement income for the rest of his life. That’s $3.5M through retirement of tax free compound interest.

He doesn't have to wait until 60, and in the event that he CAN'T wait, he doesn't have to. The amount he could receive would be less, of course, but he has options w/ MPI where he is extremely limited with a traditional retirement plan, and that matters.

Derek

Age: 39

Savings: $6k

Contribution: $1k/mo

Can Retire in 21 yrs

with $84k/yr in

TAX FREE INCOME

FOR LIFE

Derek's mom recently fell ill, and the impact of caring for declining parent has suddenly hit home. His parents lost a lot in the 2008 market crash and didn't have the time needed to recover before they would be forced to stop working. Since she now has limited resources, Derek is worried the same may happen to him one day and wants to safeguard his family from the financial devastation this can cause.

HIS GOAL: to have access to his funds for emergency, have a guaranteed retirement income, and a safeguard for his family if anything were to happen to him.

Here's the Math: He can contribute $1,000/mo and by age 55 he could receive about $48k/yr tax free, or wait till age 60 and that amount would have grown to $84k/yr, tax free for life. That's the power TIME has in combination with secure compound interest.

NOTE: By age 55, he would have contributed a total of $198,000 but able to receive $48k every year, tax free for the rest of his life. If this would have been saved in a bank, it would have only lasted 4 years at the same income. If it were to be at the mercy of the market, he would have been only able to take 4%, around $20k, with no guarantee that the money would last his life, and with no death benefit for his loved ones.

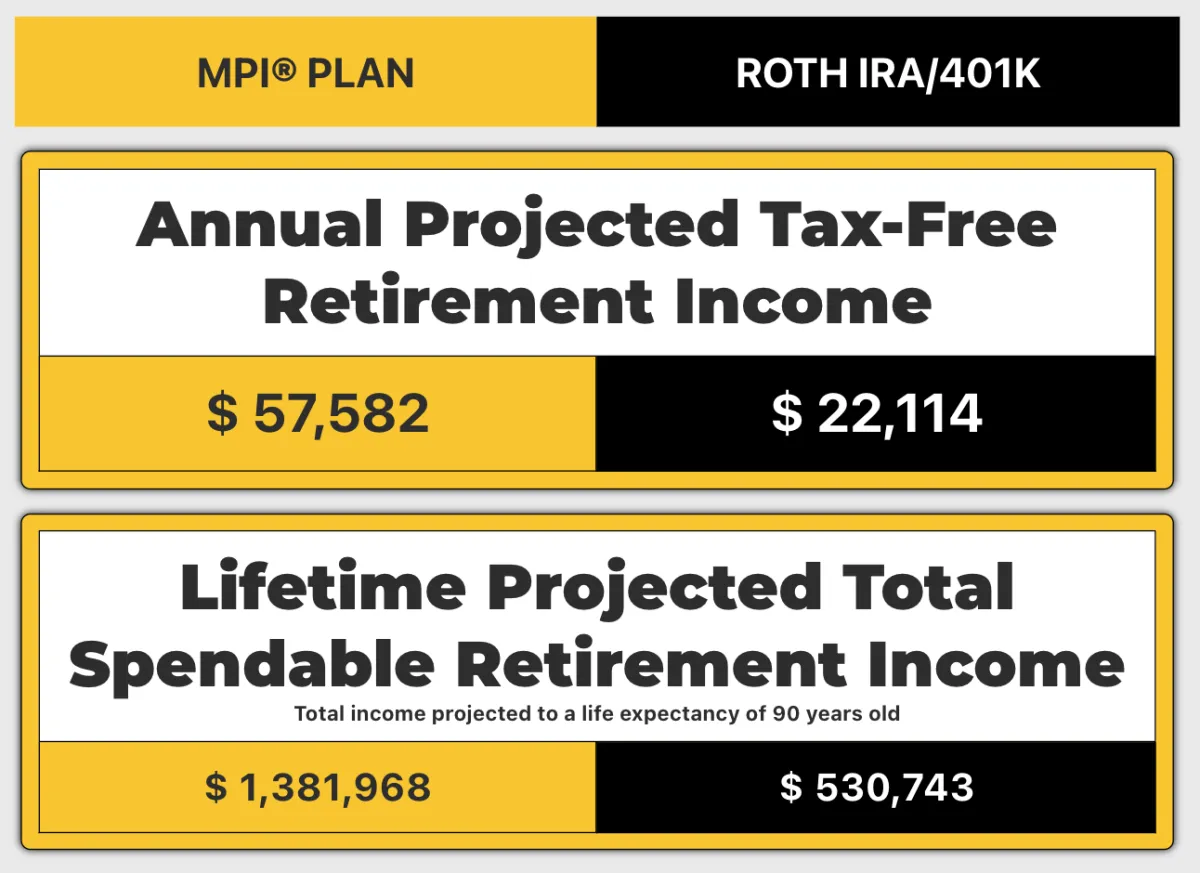

Anna

Age: 45

Savings: $30k

Contribution: $450/mo

Can Retire in 21 yrs

with an extra $57.5k/yr in TAX FREE INCOME

FOR LIFE

Anna wanted to create a plan that would supplement her current retirement income. She isn’t happy with the results her Company’s 401K plan is projected to provide. She is 45 years old with an 8 year old daughter. She has decided to contribute $450/month and a 1 time lump sum of 30K.

HER GOAL: to retire by age 66.

Here's the Math: letting her plan compound from age 45 to 66 will produce cash value of almost a half million dollars but most importantly will produce for her Tax Free Income of almost $55k for the rest of her life. That combined with her company pension is providing her with the ability to accumulate Wealth, take control of her Time while achieving true Freedom, her WTF moment.

So how did Anna get there? She scheduled a simple zoom call and we broke down the math together. Comparing her traditional plan to MPI, a secure Compound Interest producing account, and walking through how security and taxes impact those vehicles.

Jackson

Age: 51

Savings: $200k

Contribution: $15k/yr

Can Retire in 14 yrs

with $111k/yr in

TAX FREE INCOME

FOR LIFE

Jackson is 51 from North Carolina, makes a great income as an Entrepreneur but doesn’t have much of a retirement. He's on a fast track. So knowing he doesn’t have as many compound cycles as a 30 year old (remember compound cycles?), he is liquidating some assets and applying some of his savings as a lump sum over 2 years.

HIS GOAL: to retire by age 65.

Here's the Math: $100K per year as a lump sum for the 1st 2 years then contributing 10% of his income which is 15K per year. Note by age 65 he would have accumulated approximately 111K in yearly tax free income from his MPI Plan and will receive that amount for the rest of his life.

Lexi's "Nana"

Age: 53

Lexi: Age 6

Contribution: $400/mo

See How They Both Leverage the power of secure compound interest PLUS

TAX FREE INCOME

FOR LIFE

Carla doesn't qualify for an MPI plan due to her health, but she has an "insurable interest" with her granddaughter, Lexi, who is currently 6 years old. This type of strategy is actually a win-win, this example is why.

Carla won't be able to retire if she doesn't change what she is doing, she's barely back to where she was before the crash of 2008, and knows her money won't grow fast enough in her company 401k plan. She doesn't trust the stock market, and needs to feel she has some security so that she doesn't become a burden on her family.

She assumes she has another 10 solid years in the working force, but the retirement age is rising, so she may have to work even longer, if she can, at least until she is able to start using her traditional retirement funds.

HER GOAL: to "retire" at her normal age, but safeguard her family, create a more secure form of leverage for the future to be able to supplement for living expenses such as medical care, when needed.

Here's the Math: She owns the plan, but the policy is placed on her granddaughter, Lexi. Carla will contribute $400/mo for at least the next 10 years.

When Lexi is:

Age 16> Carla, 63, could receive $5200/yr for life, and/or can leverage the cash value from her MPI plan to help Lexi get a car while the money inside Lexi's plan will continue to grow

Age 20 > If Carla waits till now, age 67, she could receive $8600/yr for life, and have $105k that could be leveraged in the plan while it also continues to grow.

At this point, Lexi should be earning an income. Carla could continue to receive her income from her MPI plan, while Lexi picks up the $400/mo contributions to keep the plan compounding at the same speed. Carla would be 67 yrs old and if she is unable to work, she has options, but Lexi can leverage the mess out of this opportunity. Watch what happens:

Age 30> Carla is now 77 years old, still going strong, and possibly because she doesn't have to stress as much. If she used her traditional retirement first, and let this grow, she'd now have $25k/yr in tax free retirement income for life.

However, Lexi likely picked up the tab, and has been funding her plan. The value just continued to compound, and while in her 20's, she was able to leverage a portion of the cash value for a down payment on a home. Leverage again for her wedding, and feels confident about starting a family while building generational wealth.

Age 40> Carla is now 87 and needs more care. Lexi's MPI plan has $681k that can be leveraged to help make her grandmother more comfortable.

There are other ways to leverage this plan along the way, these are just examples. It wouldn't be fair though to only use this an example of leverage for "Nana", without showing you what it could have done for Lexi.

Age 45> Just as an example, if funded from age 6, at only $400/mo.... Lexi could now take an income of $126k/yr tax free FOR THE REST OF HER LIFE.

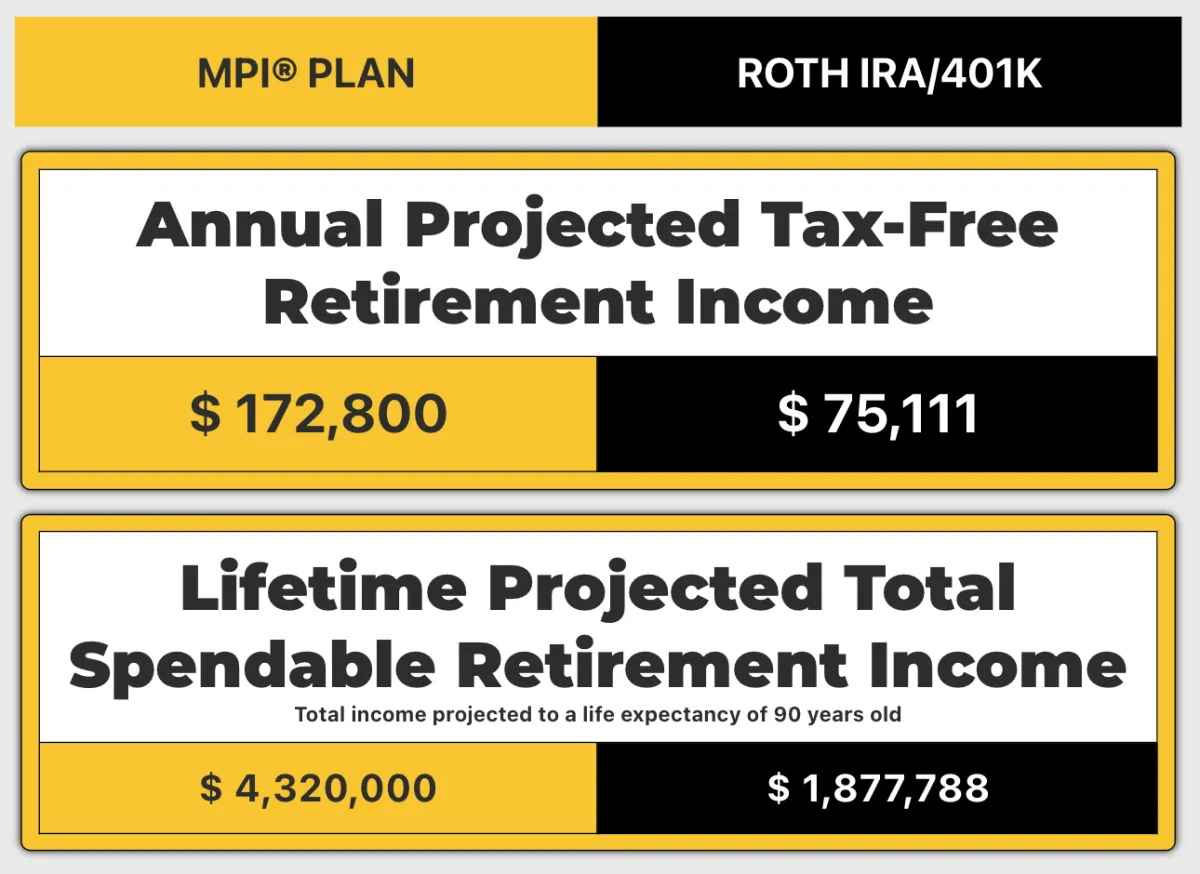

Noah

Age: 25

Income: $45k /yr

Contribution: $400/mo

Can Retire in either 25 or 40 yrs

with $172k/yr in

TAX FREE INCOME

FOR LIFE

Noah is 25, lives in Missouri, and like most his age, he would love to retire before 50. He makes a decent and secure income of $45K. He is now eligible to start contributing to his Companies Retirement Plan and wonders should he? I asked him how much he thinks he can comfortably contribute. He concluded around $400/month with no problem.

Also note, his company does offer a 5% Match… you heard that right… 5%. (is that a lot? Does that excite you?) One thing working in Noah's favor is the fact he has more compound cycles than someone my age, so if he can allow a smaller amount of money the right amount of time, he will be quite successful in his quest to retire comfortably. He also stated, he just hopes to retire a Millionaire. (Side note: LESS than 2% of Americans retire with $1M or more, Just FYI).

HIS GOAL: to securely retire, as a millionaire, by age 65. Wanted to see what would be required to achieve this by age 50.

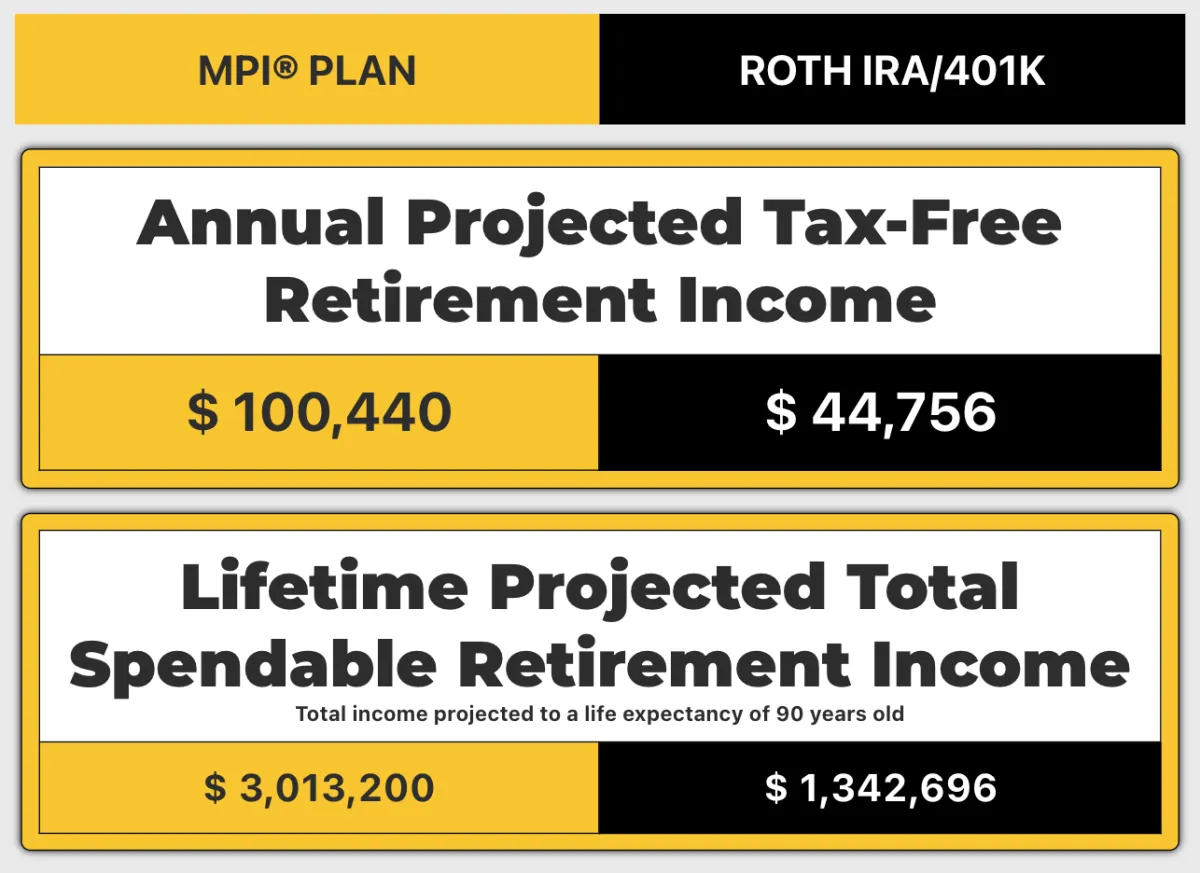

Here's the Math: Putting away $400/month which is $4,800 per year. By age 65, Noah would become a millionaire in both plans but notice the TAX FREE INCOME disparity.

Which would you prefer? $172K in yearly tax free income from his MPI Plan or $75K from a Roth IRA or 401K? So at 5% match, we are talking an additional $2K in income every year… Is his $77K any better? Lastly, he has to account for inflation when he retires. Will $75k/yr be the same as $45k right now?

If he wanted to achieve these same figures by age 50, he'd need to contribute $1400/mo, or if he needed to, he could start taking an income earlier, but the amount would be less. The calculator is helpful in showing these figures to understand your options. That is the power of compound interest, compound cycles, and why TIME is the most powerful asset we have.

Lonnie

Age: 28

Savings: $4k

Contribution: $800/mo

Can Retire in 27 yrs

with $93k/yr in

TAX FREE INCOME

FOR LIFE

Lonnie is 28 from Nevada, he's a full time content creator but hadn't really considered retirement. He knows he can't rely on this income forever and needs a plan. So he booked a call to see what kind of money his money can make for itself. Money he doesn't have to earn or be taxed on.

HIS GOAL: to be financially secure and "not have to work for his income" by age 55.

Here's the Math: He's got $4k in savings that is not growing, because money is savings is just a free loan to the bank. He wanted to see what $800/mo would do as he was confident he could commit to that.

$800/mo X 27 years = $93,524/ yr in TAX FREE INCOME <-MPI plan

$800/mo x 27 years = $36,500/yr after taxes <- Roth IRA/401K

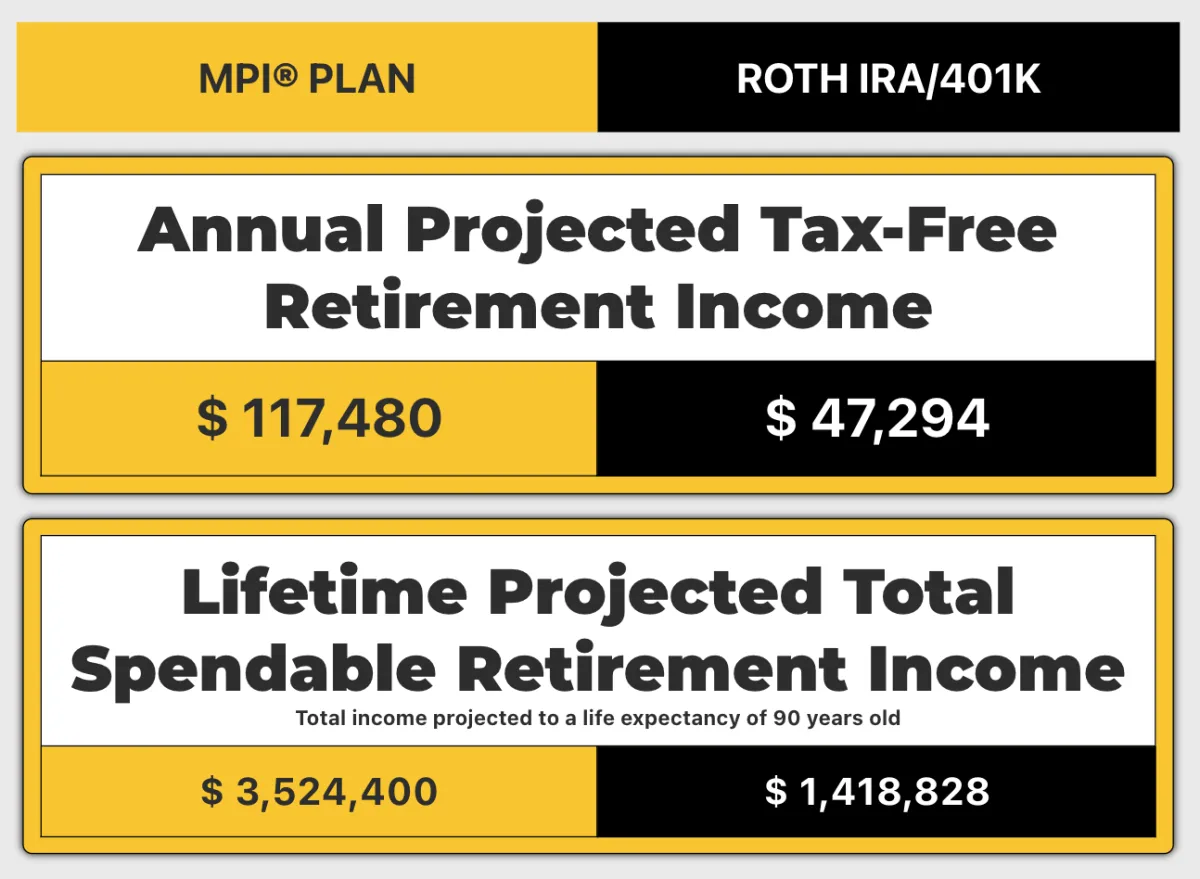

Kris

Age: 28

Income: $75k /yr

Savings: $2k

Contribution: $500/mo

Can Retire in 32 yrs

with $117k/yr in

TAX FREE INCOME

FOR LIFE

Kris just relocated to start a new job in Ohio, and contemplating whether she should contribute toward her company 401k plan, or an MPI plan. knows she needs to get a plan together as she realized she can't "save" her way to retirement.

HIS GOAL: to securely retire by age 60

Here's the Math: with only $500/mo over the course of 32 years, Kris is able to leverage up to 5+ compound cycles which means her account value will grow to around $1,041,260 and she will be able to receive $117k per year in TAX FREE RETIREMENT INCOME... FOR LIFE.

Note: If she wanted to speed this up, and retire by age 50, she'd lose the power of more than 1 compounding cycle and would have to contribute $1270/mo to yield the same income for life.

Jason

Age: 44

Savings: $16k

Contribution: $800/mo

Can Retire in 21 yrs

with almost $75k/yr in

TAX FREE INCOME

FOR LIFE

Jason is 44, lives in Arizona and spent the last year assuming MPI wasn't a good fit for him. He was very cautious during our call, but I understood why.

He's spent the last decade educating himself as an investor in the cryptocurrency space. This last market dive was enough to make him realize he needs a plan in place that isn't dependent or vulnerable due to market volatility.

HIS GOAL: to have a secure foundation of tax free income for LIFE by age 60.

Here's the Math: He's got $16k he pulled out of the market to front load his MPI plan. He knows that this money will never lose its value here and can safely grow.

He will also be contributing $800/mo from a side business he was using to buy stocks/coins, but will use this portion of his income, right now, use to fund his MPI plan.

By age 60, he will be able to receive $42,896/yr , TAX FREE for the rest of his life. That's $3,574 /mo he will always be able to count on, unlike other investments or traditional retirement plans.

NOTE: If he waits till age 65 to draw from his plan, he will receive $74,928/yr or $6,077/mo. THAT is the power of YOUR TIME w/ secure compound interest in an MPI Plan. Start Today

Kailee

Age: 18

Income: $25k /yr

Contribution: $200/mo

Can Retire in 32 yrs

with $117k/yr in

TAX FREE INCOME

FOR LIFE

Kailee just graduated highschool and not sure if she wants to go into debt to attend college. She saw her parents struggle through paying off student loan debt and now unable to stop working because their retirement plans wouldn't be enough to sustain them for the rest of their lives. It's great to see people at her age thinking ahead

HER GOAL: to become her own bank by age 30, build secure leverageable assets and securely retire when she needs to, or wants to, not when someone else decides she is "able" to.

Here's the Math: with only $200/mo over the course of 42 years, Kailee is able to leverage up to about 7 compound cycles which means her account value will grow to around $3,013,200 and she will be able to receive $100k per year in TAX FREE RETIREMENT INCOME... FOR LIFE.

Note These Examples:

By age 30, she can leverage her cash value to help her buy a home if she wants

By age 40, she can leverage the cash value again to buy an investment property, emergency expenses, or many other reasons. The leverage is hers to use.

By Age 50, let's say she or her parents have medical expenses they weren't prepared for, she can leverage her MPI plan while it continues to grow, or start taking a tax free income without having to "qualify" by being a certain age.